Canada Mortgage and Housing (CMHC) may be one of the most profitable crown corporations we have in Canada. They guarantee the lender won’t lose money if they finance a buyer/property more than 75% of its value.

Our government says it has concerns about their role with CMHC ( essentially a mortgage insurance company) – a role in which taxpayers are technically liable for the borrowers’ actions and behaviour. Yet CMHC currently has premium reserves on hand to withstand up to a 40% market devaluation).

Their average insured loan amount is $173,120 and the average Loan to (current property) Value = 53.1%. Not much of a risk so far.

The average credit score of the borrowers is 733 (good) and the average Gross Debt Service ratio (GDS) is 23.7%. Note that banks will qualify you for a mortgage with up to a 45% GDS

The Federal government (CMHC) backs these mortgages through two sorts of lenders – Traditional lenders (Banks) and Mortgage Finance companies (‘monoline lenders’).

It has been the Monoline lenders that have driven the interest rates down as they had lower overhead and were smart enough to ‘bulk insure’ their non-high ratio mortgages, resulting in substantial savings that they passed on in the way of lower interest rates.

This advantage has been eliminated by the Federal government by creating policy to heavily restrict the monoline lenders competitive edge. It is curious that when the government decided to enact stiffer regulations and restrictive legislation that they called only on the banks for consultation. Of course it is not a stretch to imagine that the result of this consultation and deliberation is a set of new regulations which threaten the very existence of monoline lenders.

The ‘Nanny State’ reasoning is to protect us from ourselves – at least that is what we are told. Part of the excuse for doing this is that the average Canadian’s debt to income ratio is way too high at 167%.

Federal regulators, and most mainstream media, would have us believe that at 167% it could effectively destroy households.

Dustan Woodhouse gave a great example of the reality of Canadian finances if interest rates double;

1. The average household debt figure is largely irrelevant to the financial success of our individual household(s)

2. What is my own debt-to-income ratio? And am I worrying about it at, say, 500%?

Would it sound reasonable to take on a $2,000 mortgage payment with a household income of $100,000?

Is it fair to say that the same $100,000 per year household income could support a $2,600 monthly housing payment?

The $2,000 per month payment represents a monthly payment at today’s interest rates on a $500,000 mortgage balance. The $2,600 per month payment represents a monthly payment at double today’s rates (when that $500,000 mortgage balance comes up for renewal). this household with their $500,000 mortgage balance and a $100,000 household income has a debt-to-income ratio of 500%.

The 500% debt-to-income household has things under control; they know that ~$1,000 of that ~$2,000 payment is principle reduction, a forced savings plan. Although few in Canada actually have a debt-to-income ratio this high; in fact, Bank of Canada research shows that just 8% of Canadians have a debt-to-income ratio above 350%.

But how do things look for the federal government’s debt-to-income ratio?

Let’s have a peak at your (or our collective) “house’s” debt to income ratio. And since the metric does not factor in equity, net worth, savings, or any assets at all when applied to us, we’ll leave them equally absent from this conversation.

Federal Gross income: $291.2 Billion

Federal Gross Debt: $1.056 Trillion

This appears to be a 363% debt-to-income ratio.

Why that’s twice our individual household debt-to-income ratio. And isn’t my mortgage debt capped for complete payout at 25 or 30 years – the maximum amortization allowable. Tell us again about the actual amortization timeline of the current national debt.

Is it the monoline lenders that have driven the interest rates so low that now the Canadian population can afford a $500,000 to $900,000 mortgage? They are actually more prudent than the banks.

Between 2013 and 2016, the characteristics of Median borrowers look like this;

|

|

Traditional lenders (*1) |

Mortgage Finance companies (*2) |

|

Credit score |

739 |

742 |

|

90-day arrears rate (%) |

0.28 |

0.14 |

|

Household income (annual) |

$80,912 |

$84,404 |

|

Loan-to-income ratio (%) |

304 |

357 |

|

Total debt-service ratio (%) |

35.3 |

37.2 |

Despite the research clearly indicating a more prudent approach to the business by Company #2 than that of their competition (Company #1).

Taking into account the relative youth of Company #2 (about a decade) vs the age of Company #1 (~150yrs) the variation of the equity (loan-to-income) held by each of its clients is more than reasonable and understandable. The narrow difference in total debt-to-service reflects the generally conservative nature of Canadians and further supports the prudent processes in place at Company #2.

Why is our government effectively trying to legislate Company #2 out of business?

Why is our government consulting only with Company #1 when the government’s own research demonstrates the people at Company #2 are doing twice as good a job when it comes to avoiding problem clients?

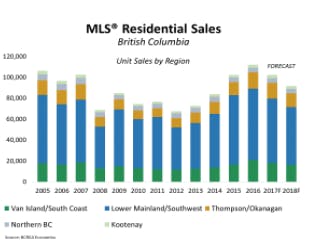

Yet despite all of the recent government interference in the real estate market, in British Columbia after a momentary slowing last fall, the market is in full throttle once again.